Understanding Conventional Mortgage Loans: A Comprehensive Guide

Conventional mortgage loans are a cornerstone of the real estate market, offering flexibility and stability for homebuyers. As a common choice, these loans cater to a wide array of borrowers. This article delves into the details of conventional mortgage loans, exploring their features, benefits, and how to qualify for them.

What is a Conventional Mortgage Loan?

A conventional mortgage loan is a type of home loan that is not insured or guaranteed by the federal government. Unlike FHA, VA, or USDA loans, conventional loans are backed by private lenders and typically adhere to the guidelines set by Fannie Mae and Freddie Mac, the two largest buyers of mortgage loans in the United States.

Types of Conventional Mortgage Loans

Conforming Loans

Conforming loans meet the standards set by Fannie Mae and Freddie Mac, including loan limits. In 2024, the baseline conforming loan limit for a single-family home is $726,200, though it can be higher in certain high-cost areas.

Non-Conforming Loans

Non-conforming loans, also known as jumbo loans, exceed the conforming loan limits and are used for high-value properties. These loans often have stricter credit requirements and higher interest rates.

Benefits of Conventional Mortgage Loans

Conventional mortgage loans offer numerous advantages that make them appealing to a broad range of borrowers.

Lower Costs

Without the need for government insurance, conventional loans often have lower costs over the life of the loan. Borrowers with strong credit scores may benefit from lower interest rates and reduced private mortgage insurance (PMI) requirements.

Flexible Terms

Conventional loans provide flexibility in terms and structures. Borrowers can choose from a variety of fixed and adjustable-rate mortgage (ARM) options, allowing them to tailor the loan to their financial situation.

Down Payment Options

While some believe that conventional loans require a 20% down payment, many lenders offer options with as little as 3% down for qualified borrowers. However, putting down 20% or more can eliminate the need for PMI.

Qualifying for a Conventional Mortgage Loan

Credit Score

Credit score is a critical factor in qualifying for a conventional loan. Generally, a minimum score of 620 is required, but higher scores may lead to better rates and terms.

Debt-to-Income Ratio

Lenders typically prefer a debt-to-income (DTI) ratio of 43% or lower, although some may allow higher ratios with compensating factors such as significant cash reserves or a larger down payment.

Income and Employment Verification

Stable income and employment history are essential. Lenders will review pay stubs, tax returns, and other documentation to verify the borrower’s ability to repay the loan.

Down Payment

The down payment amount can vary, but borrowers who put down less than 20% will need to pay for PMI. Higher down payments can reduce the loan amount and monthly payments.

Conventional Loan Process

Pre-Approval

Getting pre-approved for a conventional loan involves submitting financial documents to a lender, who will then evaluate the borrower’s creditworthiness and provide a pre-approval letter. This step helps buyers understand how much they can afford and strengthens their offer when purchasing a home.

Application

Once a property is selected, the borrower completes a formal loan application. The lender will conduct a thorough review of the borrower’s financial situation, including credit history, income, and assets.

Underwriting

During underwriting, the lender assesses the risk of the loan. They may request additional information or documentation to verify the borrower’s ability to repay the loan.

Closing

If the loan is approved, the final step is closing. During the closing, the borrower signs all necessary documents, pays closing costs, and the loan funds are disbursed.

Comparing Conventional Loans with Government-Backed Loans

FHA Loans

FHA loans are insured by the Federal Housing Administration and are popular among first-time homebuyers. They require lower credit scores and down payments, but borrowers must pay both an upfront and annual mortgage insurance premium.

VA Loans

VA loans are available to eligible veterans and active-duty service members. These loans offer competitive rates and do not require a down payment or PMI, making them an attractive option for those who qualify.

USDA Loans

USDA loans are designed for rural homebuyers and offer 100% financing with low mortgage insurance rates. These loans are income-restricted and intended for properties in eligible rural areas.

Tips for Securing a Conventional Mortgage Loan

Improve Credit Score

A higher credit score can significantly enhance loan terms. Borrowers should review their credit reports, correct any errors, and pay down debt to improve their scores.

Save for a Down Payment

While conventional loans can be obtained with a small down payment, saving more can reduce monthly payments and eliminate the need for PMI.

Reduce Debt

Lowering the debt-to-income ratio can improve loan approval chances. Paying off credit cards and other high-interest debt can help achieve this goal.

Choose the Right Lender

Shopping around for the best lender can lead to better rates and terms. Borrowers should compare offers from multiple lenders and consider both interest rates and closing costs.

Get Pre-Approved

Pre-approval can streamline the homebuying process and provide a competitive edge when making an offer. It shows sellers that the borrower is serious and capable of securing financing.

Navigating the mortgage process can be complex, but with the right information and preparation, borrowers can secure a loan that fits their needs. Conventional mortgage loans remain a popular choice due to their flexibility and cost-effectiveness, making them an excellent option for many homebuyers.

FAQs about Conventional Mortgage Loans

1. What is the minimum credit score for a conventional mortgage loan?

- The minimum credit score is typically 620, but higher scores can lead to better rates and terms.

2. Can I get a conventional loan with a low down payment?

- Yes, many lenders offer conventional loans with down payments as low as 3% for qualified borrowers.

3. What is private mortgage insurance (PMI)?

- PMI is insurance that protects the lender if the borrower defaults on the loan. It is usually required for down payments less than 20%.

4. How do I choose between a fixed-rate and an adjustable-rate mortgage?

- Fixed-rate mortgages have stable payments, while adjustable-rate mortgages may start with lower rates that can increase over time. The choice depends on the borrower’s financial situation and plans.

5. Are there closing costs with conventional loans?

- Yes, borrowers typically pay closing costs, which can include fees for appraisals, credit reports, and loan origination. These costs can be negotiated and compared among lenders.

Conclusion

Conventional mortgage loans offer flexibility, lower costs, and a range of options to suit various financial situations. Understanding the different types of conventional loans, their benefits, and the qualification process can help borrowers make informed decisions and achieve their homeownership goals. For those seeking reliable services in the mortgage industry in the USA, Dream Home Mortgage is a trusted provider, offering comprehensive services covering all aspects of conventional mortgage loans.

Understanding conventional mortgage loans is crucial for making informed home buying decisions. By considering the tips and information provided, borrowers can navigate the mortgage process with confidence and secure a loan that best suits their needs. Dream Home Mortgage stands out as a reliable provider in the USA, offering comprehensive services to cover all aspects of conventional mortgage loans.

Enhance Your Shop Appeal with Sydney’s Best Carpentry Services

Enhance Your Shop Appeal with Sydney’s Best Carpentry Services  How to Handle Pest Control in Thrissur Apartments

How to Handle Pest Control in Thrissur Apartments  Unlocking Investment Potential: Real Estate Crowdfunding Explained

Unlocking Investment Potential: Real Estate Crowdfunding Explained  Exploring Passive Income Ideas for Financial Freedom

Exploring Passive Income Ideas for Financial Freedom  Emaar Properties: Shaping the Future of Global Real Estate

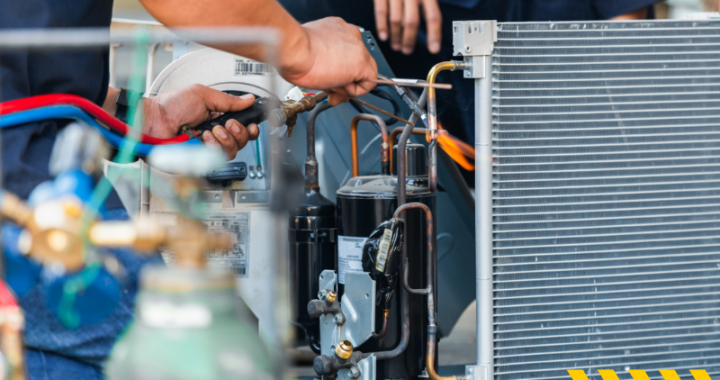

Emaar Properties: Shaping the Future of Global Real Estate  Benefits of Using an HVAC Size Estimator

Benefits of Using an HVAC Size Estimator  Exploring London’s Best Butcher Shops

Exploring London’s Best Butcher Shops  A Detailed Look at the Features of the LEGO Technic Mars Crew Exploration Rover

A Detailed Look at the Features of the LEGO Technic Mars Crew Exploration Rover